5 Best Medicare Supplement Plans Near Me

When selecting a Medicare Supplement plan, various factors need to be considered, including price, financial strength of the provider company, customer service reputation and customer experience. All plans offer similar coverage regardless of which insurance company offers them.

Cigna boasts over 130 years of experience and offers a variety of policy options for its customers. Additionally, they are known for having a low complaint rate and earned an A+ rating with AM Best.

Aetna

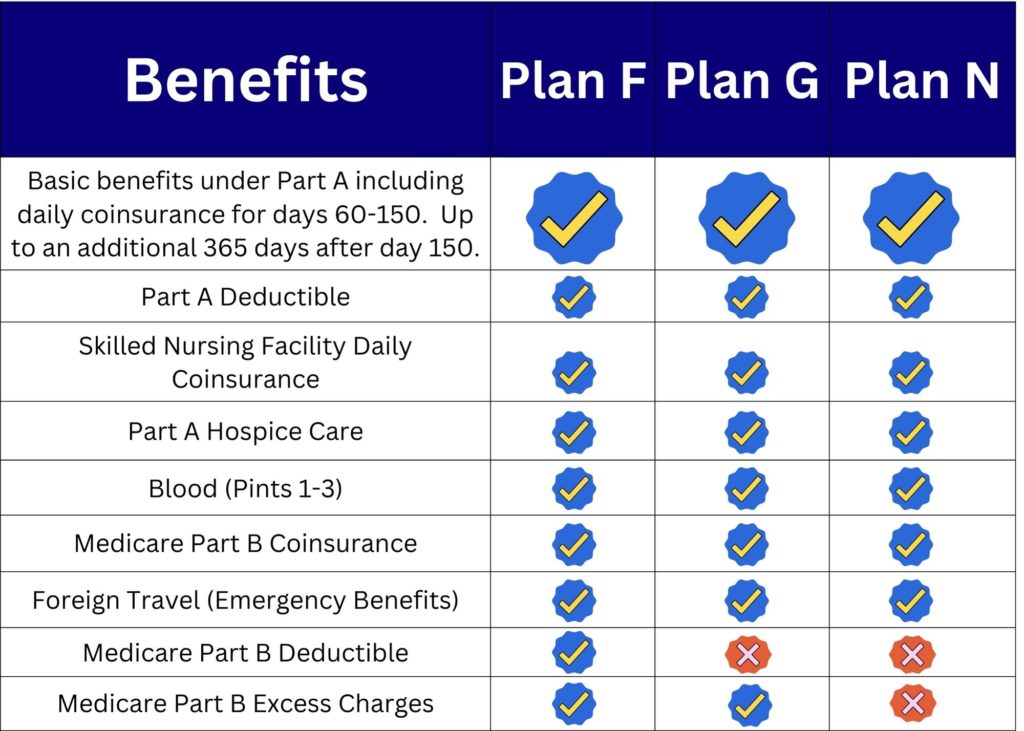

Aetna Medicare Supplement plans provide coverage of any gaps left by standard Parts A and B policies, as well as copays for medical visits and some hospital charges. Plans F, G and N are available across most states with Aetna’s nurse care manager available 24/7 for support.

This insurer boasts high ratings from credit agencies. Their extensive network enables them to more efficiently manage costs and anticipate trends, thus helping to maintain steady rates without sudden spikes, which is important consideration for those living on fixed incomes. Members of Aetna also can take advantage of ancillary benefits like 24-hour nurse hotlines, meal delivery during hospital stays and discounts on over-the-counter drugs. Aetna provides final expense life insurance policies at discounted prices when purchased with Medicare Supplement policies from them, and customers have reported being pleased with Aetna’s customer service; though it did score lower in one J.D. Power survey than some competitors.

Blue Cross Blue Shield

Blue Cross and its affiliates provide Medicare Supplement (Medigap) plans that fill any gaps in Original Medicare. This helps lower out-of-pocket expenses and is accepted at every hospital or provider nationwide that accepts Medicare.

Cigna and Mutual of Omaha Medicare Supplement providers often offer lower rates compared to UnitedHealthcare, offering premium discounts such as nonsmoker and cholesterol discounts. Furthermore, UnitedHealthcare also offers multiple nonsmoking and cholesterol discounts as part of their premium discounts package.

Visit their website and enter your ZIP code under Medigap Insurance to receive quotes from Blue Cross Blue Shield. Rates may differ based on plan type, location and other factors – for instance Blue Cross Blue Shield’s Plan F may have higher premiums than Plan G from other providers. It is also important to keep in mind that Medicare Supplement rates tend to increase annually; so review your policy annually and consider changing insurers if your rates become too expensive.

Colonial Penn Life Insurance Company

Colonial Penn provides various Medicare supplement policies (Medigap) in most states, which cover out-of-pocket medical expenses after original Medicare has paid its share. They also offer riders such as accidental death benefits and coverage for chronic and terminal illness.

Medigap plans offered by this company come in three basic versions – Plan A, Plan F and an enhanced high deductible version of Plan F. Plan F offers comprehensive coverage that meets most out-of-pocket expenses not covered by original Medicare.

Gerber also provides guaranteed acceptance insurance policies, or final expense policies, tailored specifically for people over 50. These plans do not require medical exams and offer flexible payments and cash value. Unfortunately, there have been allegations that the television advertisements mislead consumers, leading to overpaying by seniors for policies with two year waiting periods that do not offer high coverage limits; alternatively other companies like Gerber and Mutual of Omaha provide better pricing with more lenient underwriting standards for these policies.

Mutual of Omaha

Mutual of Omaha stands out among its competition as an industry-leading Medicare Supplement insurance provider by offering policyholders many special perks – guaranteed renewal, household discounts, and a free benefit booklet being just some. They also offer Medicare Part D prescription drug plans.

Mutual of Omaha also offers a high-deductible version of Medicare Supplement Plan F from Mutual of Omaha. While this may appear advantageous, be mindful that as you age your premiums will rise regularly as attained-age pricing takes effect in states that permit it.

Mutual of Omaha has been around since 1909 and boasts outstanding third-party ratings for customer satisfaction and financial stability. Their headquarters is based in Omaha, Nebraska and they offer an array of supplemental health and life insurance products as well as various Medicare Advantage plans with dental and vision coverage options.